maine excise tax rate

Beginning April 1 1984 upon payment of the excise tax the municipality shall certify on forms provided by the Department of Inland Fisheries and Wildlife. Excise Tax Calculator Bar Harbor Maine.

Free Maine Motor Vehicle Bill Of Sale Form Pdf

6 hours ago Web Excise Tax Calculator This calculator will allow you to estimate the amount of.

. Excise Tax is calculated by multiplying the MSRP by the mil rate as shown to the right. Share this Page How much will it cost to renew my registration. The federal gasoline excise tax is a tax that was implemented to fund transportation-related projects.

The excise tax you pay goes to the construction and. As of August 2014 mil rates are as follows. Visit the Maine Revenue Service page for updated mil rates.

The rates drop back on January 1st each year. 18 rows Commercial Forestry Excise Tax. Enter your vehicle cost.

Property Tax Educational Programs. Tax Rate Per 1000 2000 mils. Title 36 1504 Excise tax.

Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. 4 The fuel excise tax rates in effect on July 1. Property Tax Law Changes 2022.

Designed to provide the public with answers to some of the. Definition And Example Of The Federal Gasoline Excise Tax Rate. The excise tax due will be 61080.

Departments Treasury Motor Vehicles Excise Tax Calculator. A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle. This calculator is for the renewal registrations of passenger vehicles only.

Watercraft Excise Tax Rate Table. 22500 X 0100 225. 13 rows Maine Tax Portal.

YEAR 1 0240 mil rate YEAR 2. 2721 - 2726. Property Tax Stabilization Program.

Maines Office of the Revisor of Statues explains that youll pay 5 per year in excise tax if you own a motor vehicle. How much will it cost to renew my. Maine Watercraft Excise Tax Law - Title 36 Chapter 112.

For questions about your tax bill please contact the Division of Collection and Treasury. March 2023 Certified Maine Assessor. Contact 207283-3303 with any questions regarding the excise tax calculator.

Watercraft Excise Tax Payment Form - 2022. The rates drop back on January 1st each year. Mil rate is the rate used to calculate excise tax.

Tax Return Forms. July 1 - June 30. Excise Tax is calculated by multiplying the MSRP by the mil rate as shown below.

16 rows Effective July 1 2009 the full diesel excise tax rate is imposed on biodiesel fuels that contain less than 90 biodiesel fuel by volume. These rates apply to the tax bills. Interest Rates 1992 to Present.

Welcome to Maine FastFile. Maine auto excise tax rates Show details. To calculate your estimated registration.

- NO COMMA For.

I Team Maine Excise Tax Among The Highest In Us How Is That Money Spent Wgme

How Do State And Local Property Taxes Work Tax Policy Center

Maine Sales Tax On Cars Everything You Need To Know

Motor Vehicle Excise Tax Finance Department

Maine Vehicle Sales Tax Fees Calculator

Property Tax Stabilization Program For Seniors Cumberland Me

Motor Vehicle Registration The City Of Brewer Maine

Maine Reaches Tax Fairness Milestone Itep

Tobacco Vaping 101 Maine Taxpayers Protection Alliance

Historical Maine Tax Policy Information Ballotpedia

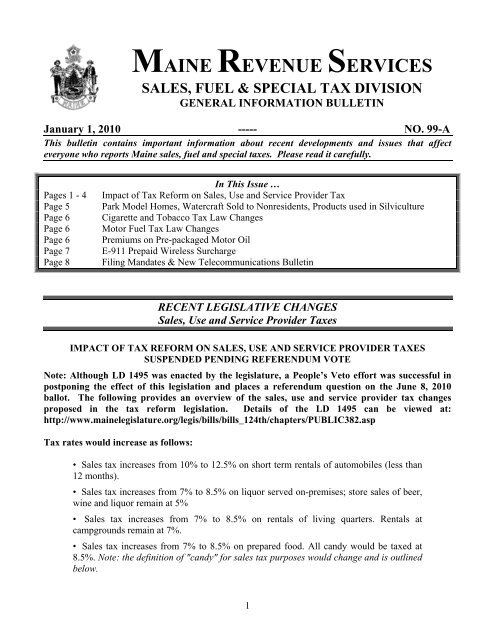

Sales Fuel Amp Special Tax Division Maine Gov

Maine Auto Excise Tax Repeal Question 2 2009 Ballotpedia

How Much Drivers Pay In Taxes At The Pump In Maine Maine Thecentersquare Com

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

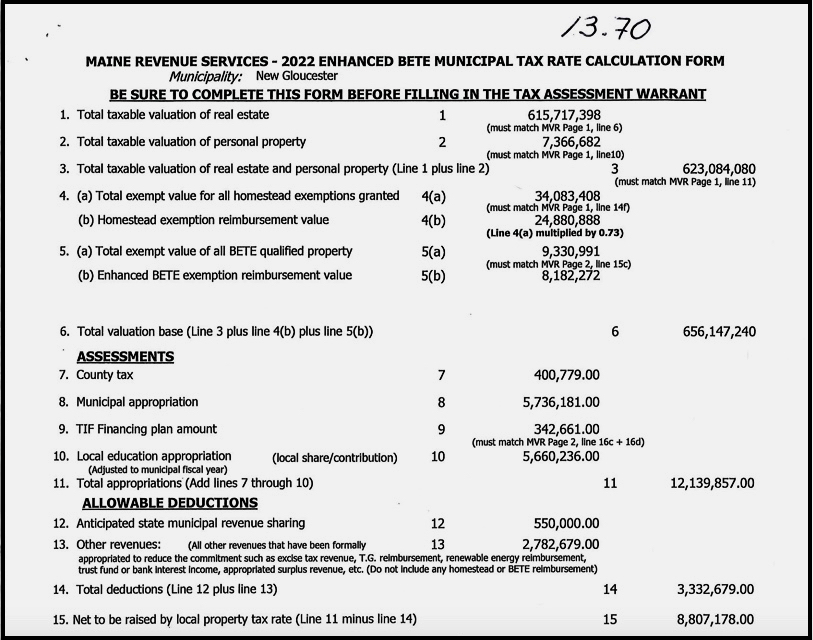

Select Board To Set Fy23 Tax Rate Hear Roads Analysis Upper Village Planning Update Ngxchange

Why Maine License Plates Jam Out Of State Highways Portland Press Herald